Tune-up your 401(k) for 2017

/A 401(k) plan is a remarkable retirement tool, but it requires a little routine maintenance. Here’s what to look for.

MAXIMUM CONTRIBUTIONS

First, verify you are contributing the maximum possible. The most an employee can contribute for 2017 is $18,000. But the catch up amount for those ages 50 and older is $6,000. Every dollar you contribute lowers your current taxable income. If you think your tax rate will actually be higher

in retirement, consider switching to a Roth 401(k). Your contributions won’t reduce taxable income, but later withdrawals will be tax-free.

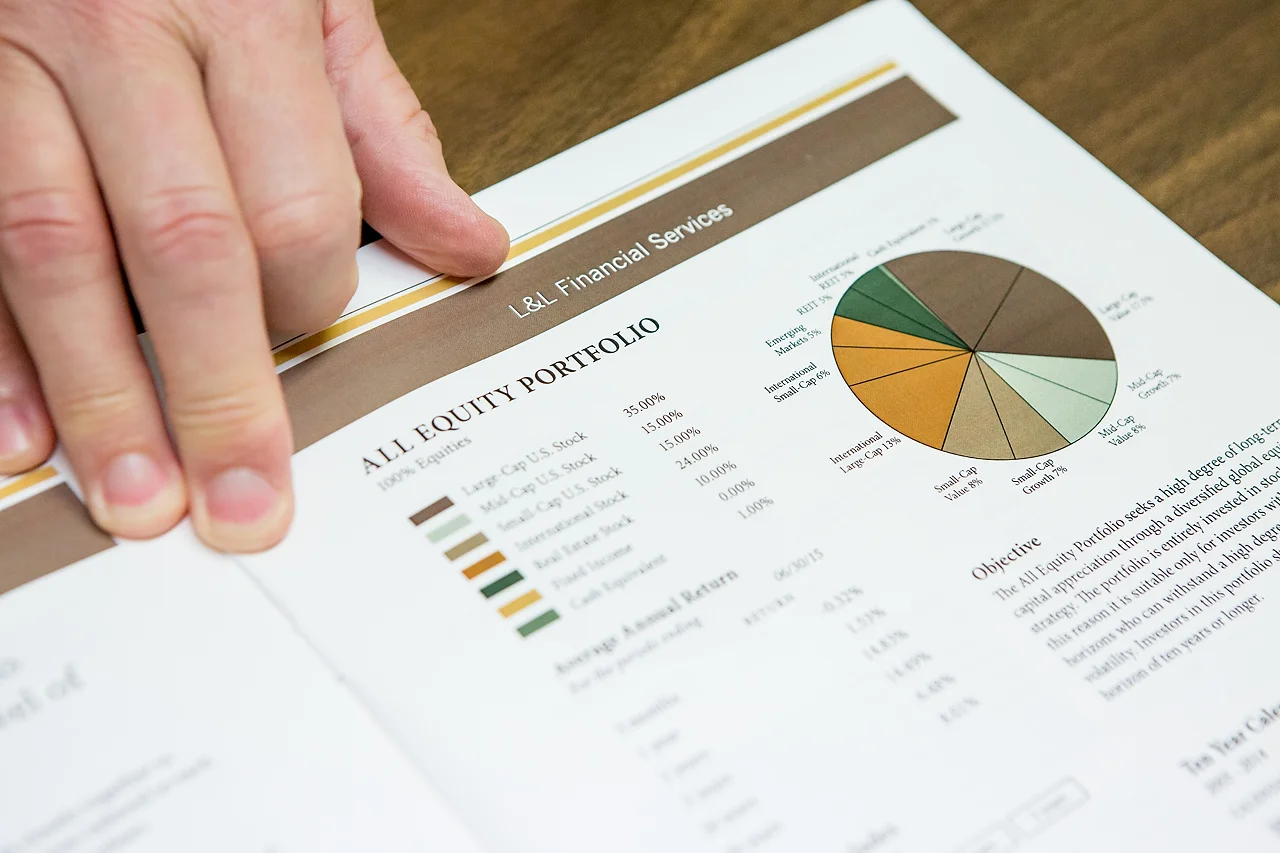

INVESTMENT ALLOCATIONS

With the recent stock market fluctuations, now is also a good time to review your 401(k) investment allocation. You might find your portfolio out of balance or too concentrated in certain areas. For convenience and peace of mind, consider investing in funds that do the re-balancing for you based on how long you have until retirement.

INVESTMENT FEES

And while you are looking at your investments, take a peek at the fees you are paying. Recent law changes require investment companies to disclose their fees, and you could be surprised at what you pay. Next to taxes, investment fees are one of the biggest threats to your retirement earnings over time. Of course, investment fees should be compared to performance history for a complete picture.

UPDATE YOUR BENEFICIARY INFORMATION

Something many people forget to update is their 401(k) beneficiary information. Changes in family members, married status, or other life events may require a revision to your plan records. Beneficiary information should also be updated for new contact information. You may even decide to donate your plan after you pass away and list your favorite charity as a beneficiary.

Finally, don’t forget to review and update those retirement accounts you have kept at previous employers.

For help with these and other retirement issues, contact our office. ♦